2022 Dental Insurance Reform Survey Results

Thank you for responding to the Dental Insurance Survey sent out in March of 2022. The information below are the Survey results and recommendations moving forward.

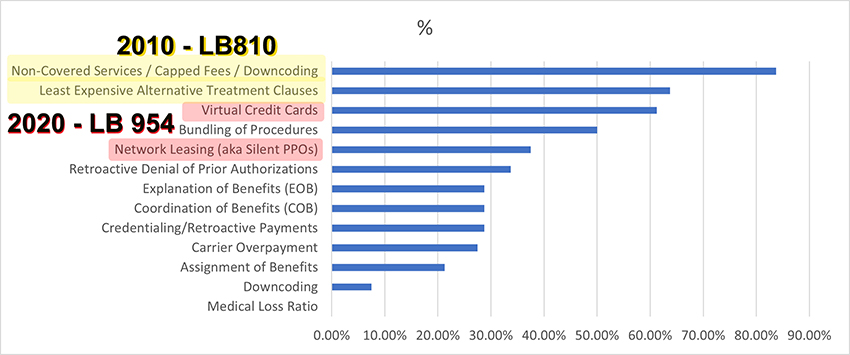

Over 92% of NDA members "has had/is having an issue(s) with third-partypayer(s)" No great surprise. The chart below identifies the Dental Insurance Issues of all categories.

Meeting with Attorney General Doug Peterson

First, thank you to the 84 NDA members who filled out the Dental Insurance Reform Survey in April. The results of the Survey are displayed in the chart below. The information and related comments were critical in forming the discussion we had with the Nebraska Attorney General’s office on June 7th, 2022.Statutory Enforcement

Why the need for a meeting with the Attorney General’s office? As the chart below demonstrates, we already have laws on the books governing insurance companies interaction with dental offices . . . its just not being enforced. Our 10 year saga with non-covered services - the leading issue in the survey - is proof of that. The ADA State Government Affairs office has been working with states to address statutory enforcement of dental insurance laws. Paul O’Connor from the ADA and Dusty Brighton, a consultant working with Attorneys General from all over the U.S., joined Dr. Scott Morrison, NDA Legislative Chair and myself in our meeting with Doug Peterson, Nebraska’s Attorney General.

Why the need for a meeting with the Attorney General’s office? As the chart below demonstrates, we already have laws on the books governing insurance companies interaction with dental offices . . . its just not being enforced. Our 10 year saga with non-covered services - the leading issue in the survey - is proof of that. The ADA State Government Affairs office has been working with states to address statutory enforcement of dental insurance laws. Paul O’Connor from the ADA and Dusty Brighton, a consultant working with Attorneys General from all over the U.S., joined Dr. Scott Morrison, NDA Legislative Chair and myself in our meeting with Doug Peterson, Nebraska’s Attorney General.The ADA created the two page NDA Dental Insurance Reform Survey Results handout that we presented to A.G. Peterson. We were quite fortunate to be speaking directly to A.G. Peterson instead of being handed off to one of many attorneys within the A.G.’s office. I was able to explain the long history we have had with non-covered services since 2010, including examples of EOBs showing the inequity of being forced to accept a low fee for a higher priced procedure . . . that is still happening today, even though we have a law that prevents it. A.G. Peterson was particularly interested in my examples of downcoding on an implant bridge and implant crown, shown below. I informed him that I know this is still happening as a received an email from a member in May 2022.

Dr. Morrison and Paul O’Connor explained that dental insurance really isn’t insurance, but a dental benefit plan, much like a gift card. Dusty Brighton explained his experience with the A.G. in Mississippi that will be getting involved in statutory enforcement. The lack of enforcement of laws on the books continues to disrupt the relationship between dentist and patient, as the patient believes what the EOB is showing instead of what the state law says. I was encouraged that AG Peterson asked to keep my copy of two EOBs sent in by NDA members, that showed an implant crown and implant bridge - and the insurance company changing the code, then showing that the patient did not owe the higher balance. His comment toward the end of the meeting was that the situations we were describing were really consumer protection issues.

I’m hopeful that this meeting will lead to more dialogue with the A.G.’s office and enforcement of laws we fought hard to enact on behalf of our members

Good News / Bad News

The good news is that we have addressed 4 of the top 5 issues in legislation that has passed. The bad news is that we are still having issues with them.

I consider Non-Covered Services / Capped Fees / Downcoding and Least Expensive Alternative Treatment Clauses different phrases for the same animal that we addressed in LB 810 in 2012 - Non-Covered Services.

What we learning in our recent litigation with the Department of Insurance, was that insurance companies like Ameritas didn't even know what LB 810 said. As this 2014 Email from Laura Arp to Ameritas indicates, Ameritas assumed LB 810 reflected the NCOIL statutory language that many other states passed . . . it did not!

Educate Your Patients

Please have ALL of your insured patients sign the Non Covered Services Patient Acknowledgement at their next appointment before you treat them. Because many insurance companies are either unaware or ignore our Non-Covered Services statute, we must educate our patients BEFORE they receive an EOB that states they do not owe any more money for a procedure that their dental benefit plan does not cover.

Virtual Credit Cards / Network Leasing (aka Silent PPOs)

The NDA addressed both of these issues in 2020 with the passage of LB 954, now appearing in Neb.Rev.Stat. 44-7,110.

44-7,110(2) A dental insurance plan, contract, or provider network contract with a provider shall not include any restrictions on methods of claim payment for dental services in which the only acceptable payment method is a credit card payment.

If an insurance company is not abiding by 44-7,110, send them a version of Provider Agreement Letter Virtual Credit Card and copy Laura Arp at the Department of Insurance.

Network Leasing

The requirements for an insurance company leasing their dental network also appear in Neb.Rev.Stat. 44-7,110. Notable requirements:

(3) A dental carrier may grant a third party access to a provider network contract, if, at the time the provider network contract is entered into or renewed, the dental carrier allows a provider who is part of a dental carrier's provider network to choose not to participate in third-party access to the provider network contract. The third-party access provision of the provider network contract shall be clearly identified. A dental carrier shall not grant a third party access to the provider network contract of any provider who does not participate in third-party access to the provider network contract.

(4) A contracting entity may grant a third party access to a provider network contract, or a provider's dental services or contractual discounts provided pursuant to a provider network contract, if the following requirements are met:

(a) The contracting entity identifies all third parties in existence in a list on its Internet website that is updated at least once every ninety days;

(b) The provider network contract specifically states that the contracting entity may enter into an agreement with a third party that would allow the third party to obtain the contracting entity's rights and responsibilities as if the third party were the contracting entity, and when the contracting entity is a dental carrier, the provider chose to participate in third-party access at the time the provider network contract was entered into; and

(c) The third party accessing the provider network contract agrees to comply with all applicable terms of the provider network contract.

(5) A provider is not bound by and is not required to perform dental treatment or services under a provider network contract granted to a third party in violation of this section.

(6) Subsections (3), (4), and (5) of this section shall not apply if any of the following is true:

(a) The provider network contract is for dental services provided to a beneficiary of the federal medicare program pursuant to Title XVIII of the federal Social Security Act, 42 U.S.C. 1395 et seq., or the federal medicaid program pursuant to Title XIX of the federal Social Security Act, 42 U.S.C. 1396 et seq., as such sections existed on January 1, 2020; or

(b) Access to a provider network contract is granted to a dental carrier or an entity operating in accordance with the same brand licensee program as the contracting entity or to an entity that is an affiliate of the contracting entity. A list of the contracting entity's affiliates shall be made available to a provider on the contracting entity's website

The majority of provider agreements automatically renew annually. Assuming the many dental carriers are not up to speed on 44-7,110, I would recommend that you send some version of the Provider Agreement Letter Network Leasing

Future Legislation

Thanks to your participation in the DIR Survey, the Legislative Council will be reviewing the remaining issues identified in the Survey as to future legislative actions.